NextGen Finance Blueprint™

A deep dive into the 5 parts of your financial structure

You’re in this for the long term. So let’s build like it.

In the NextGen Finance Blueprint™ we assess your finances according to a 5-part framework that ranges from basic accounting to high-level strategy.

The result? You get the holistic perspective you need to manage your money wisely from now on, even if you grow to $100M and beyond.

1-on-1 time with a Fractional CFO

to talk through your problems, goals, and questions

Actionable recommendations report

based on a thorough look at your numbers and financial structure

Healthy Financial House™ framework

so you’re never lost, even if you don’t have a finance degree

Bring the fuzziness into focus with the NextGen Finance Blueprint™

The NextGen Finance Blueprint™ is a CFO-led deep dive into your finances, conducted from the ground up. Over the course of 3 to 6 weeks, we run a systematic analysis of your financial structure, including your:

- Reporting capabilities

- Accounting software

- Payment and contract processes

- Risk management

- KPIs and performance metrics

- Internal controls to prevent fraud and data loss

- Trends

- Profitability

- Resource management (think cash, debt, and inventory)

- Budgeting process

- Forecasting practices (short-term and long-term)

- High-level strategic planning

Book your NextGen Finance Blueprint™ as a standalone service, or use it as an on-ramp to hiring a Fractional CFO. Either way, you get eye-opening insights you can start using immediately.

And you’ll get them delivered in the form of clear, specific action items, broken down by category and ordered by priority.

Because the last thing you need is a bunch of scattered reports and fuzzy directives that just add to the madness.

Change your perspective

Adopt a clearer model for thinking about your money with our 5-part Healthy Financial House™ framework.

Address problems at the source

Stop putting out fires. Start finding what’s sparking them in the first place and fix it.

Get a manageable action plan

Take away a roadmap that makes progress seem simple: “Do this. Then this. Then this.”

You can’t plan for your financial future when you’re playing crisis whack-a-mole all day long.

It’s the curse of success: you’re so busy meeting demand that you have no time to focus on building your business. So you end up trapped in a constant state of emergency.

Life in Crisis Mode

- Chasing after rogue P.O.s and invoices instead of tracking every call, job, and doc in one place

- Dipping into reports at random instead of checking KPIs like clockwork

- Scrambling to cover cash crunches and inventory shortages instead of anticipating them with better forecasting

- Basically, waiting for things to go wrong and then rushing to fix them, because you have no way to plan for problems before they happen

Piecemeal problem-solving won’t cut it.

You need to step back and see the whole structure.

Bouncing from meltdown to meltdown is killing you.

But to fix it, you need a few things:

- A process you can commit to so that progress takes priority

- An expert who can identify the issues you haven’t been trained to spot

- A framework that breaks you out of the scattered approach you’re stuck in

The process and the expert are built into any decent financial strategy assessment. The framework is what makes our version work so well.

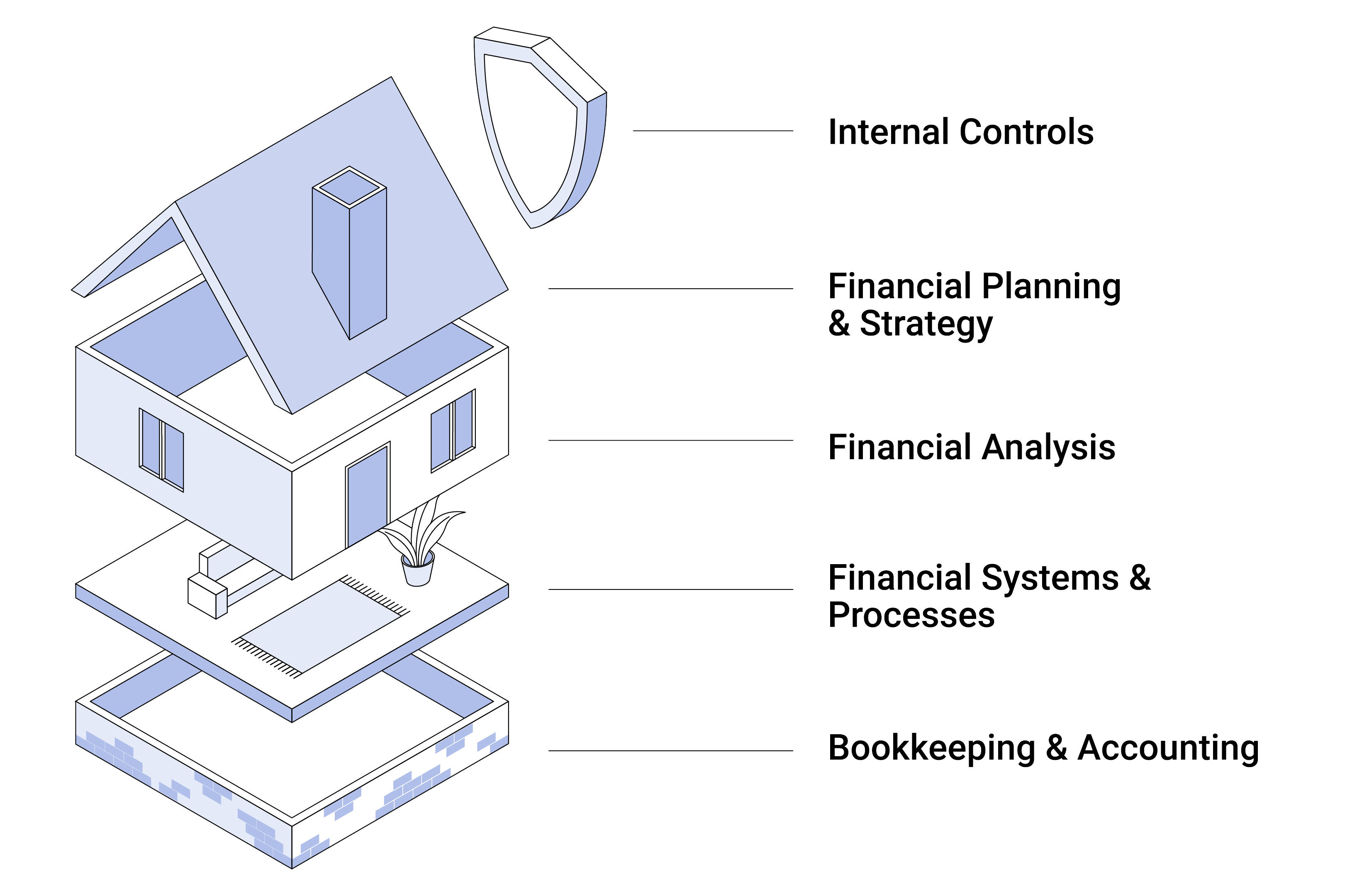

Meet the Healthy Financial House™ framework

The 5-part financial blueprint for building a healthy and sustainable business

When you book a NextGen Finance Blueprint™, you get an in-depth breakdown of your business’s financial structure across 5 carefully chosen categories.

We call this method the Healthy Financial House™ framework.

The beauty of the framework is that it doesn’t just help you uncover flaws and find fixes. It shifts your whole mental model of your money by pushing you to see the big picture.

Watch NewCastle Finance founder Kathy Svetina break down her Healthy Financial House™ framework.

To learn more about each aspect of the Healthy Financial House Framework™, click on the green circles next to the item.

The Foundation

First things first: let’s make sure you’re properly recording your transactions. Because we can't run analysis on numbers we don’t trust.

- Confirm you’re collecting timely and accurate info

- Make sure you can access data easily on a regular basis

- Start transitioning from cash to accrual accounting

The Interior Design

Most small businesses struggle to collect financial data smoothly. Let’s straighten out your systems so you’re always looking at up-to-date info.

- Get onto the right accounting or CRM software

- Clean up your payment and contract processes

- Find the reporting bottlenecks that block you from making data-driven decisions

The Walls

Do you sometimes struggle to interpret your numbers? After we’re finished, you’ll be able to tell what’s happening at a glance.

- Find out which KPIs you should regularly monitor (and which numbers you can mostly ignore)

- Uncover any potentially dangerous financial weaknesses

- Spot trends that can help you plan for where you’re headed

The Roof

Set your objectives. Design plans to achieve them. This is how we map out the future of your business.

- Assess how you’re managing resources like debt, cash, and inventory

- Review best practices on creating budgets and forecasts

- Learn how to set up annual strategic planning habits to chart your direction

The Security Alarm

Prevent a disastrous setback by guarding against fraud, abuse, and data loss. (Small businesses often underestimate this threat.)

- Add checks and balances to your bookkeeping to prevent manipulation

- Check your data backup practices so that a failure won’t be catastrophic

- Adopt proper auditing so you can catch mistakes and abuse before they snowball

Walk away with an in-depth report that spells out exactly what to do next

Your NextGen Finance Blueprint™ includes

- 20- to 40-page PDF summarizing your status

- Analysis across 5 categories, with key takeaways for each section

- Final recommendations ranked by priority so you know where to focus first

- 90-minute wrap-up meeting to review findings and answer questions

Advantages of the Healthy Financial House™ framework

See the full picture

The 5-part structure helps you finally look at your finances holistically. And that perspective shift is permanent: you’ll think more clearly about your finances from now on.

Understand your money in your terms

You’re not a CFO. So the framework uses language and concepts that make sense even if you don’t spend your free time ranking your all-time favorite Excel formulas.

Make high-impact improvements first

Because we start our analysis with the basics and work our way up, it’s easy to spot the no-brainer fixes you should make right away.

Build for the long-term

The 5 basic pieces of a healthy financial structure don’t change whether you’re at $1M or $1B. So putting them in place now will serve you no matter how big you grow. And the earlier you do it, the easier it is to get it right.

How it works

1

Diagnostic call

Spend 90 minutes discussing your finances with Fractional CFO Kathy Svetina to identify your main challenges, goals, and priorities.

2

Deep dive into your finances

Over the next 3 to 6 weeks, we delve into your numbers, systems, and strategy to uncover your biggest opportunities.

3

Final report and wrap-up call

You receive a full report complete with prioritized recommendations. Afterward, we hold another 90-minute call to review your results, clarify next steps, and answer your questions.

Remember: as your business grows, it only gets harder to rebuild it right

Overhauling your finances may seem like a lot. But just imagine how much harder it will be to alter your financial structure after building on top of it another year.

The whole point of the Healthy Financial House framework is to identify the 5 basic components that will sustain your business from here on out, even if it blossoms into the billions.

So by building the structure correctly now, you’re not just getting the power to make smarter, more confident decisions. You’re saving yourself from a much more painful process when a disaster finally forces you to fix it.

Click below to get started with your

NextGen Finance Blueprint™

$9,500 flat-rate pricing

Standalone service, or on-ramp to a Fractional CFO

Consultation required to book. All NewCastle Finance clients must have a NextGen Finance Blueprint™ done before further advisory services begin.

Resources

© 2019-2024 NewCastle Finance LLC. All Rights Reserved.