The three musketeers are not only well-known characters found in a famous novel – they’re present in day-to-day business life, too. Better known as income statement, cash flow statement, and balance sheet, these three important financial statements work together to illustrate how a business is doing.

The first two, income and cash flow statements, are typically well understood by business owners; even used effectively. But the last one – the balance sheet? Unfortunately, it often gets left out or forgotten about. This is often due to its reputation as being overly complicated, too time-consuming, or – gasp! – even unnecessary.

But it doesn’t have to be that way!

When you understand the role a balance sheet plays in your company’s finances, you can make better financial decisions. Combine balance sheet knowledge with the income statement and cash flow statement knowledge, and get ready to rule your kingdom – errr business! – just like the original three musketeers did.

Here’s how!

Balance Sheet Definition

A –provides a snapshot of what your business owns, owes, and the amount invested by its owners. As arguably the most important of the three main financial statements, it provides insight into your company’s overall financial position as of a specific date.

This financial document lists and tallies up all of your company’s assets, liabilities, and owner’s equity. The final result is your company’s book value. Details from previous years also may be included so that you can easily make back-to-back comparisons.

Small businesses should prepare a balance sheet at least every quarter, but optimally monthly. If you use a bookkeeper or accountant, balance sheet preparation should be included in their reporting package. When you receive the completed document, take the time to thoroughly review its results – just like you do with your P&L statements.

The Importance of a Balance Sheet

If you’re a business owner looking for additional debt or equity financing, a current and accurate balance sheet is essential. It’s also a must when you’re preparing to sell your business and need to determine its net worth. Depending on who is reviewing it, a balance sheet can serve multiple purposes.

Business leaders, key stakeholders, and employees use balance sheets to identify whether a business is succeeding or failing. Using a balance sheet’s information, internal stakeholders can determine the best way to achieve organizational goals, meet financial obligations, and use credit to finance business operations.

Potential business investors use balance sheets to decide whether or not to invest in a company. By reviewing business resources and financing details, they can make projections to calculate metrics such as liquidity (how quickly your company’s assets can convert into cash), profitability (your company’s ability to generate profits), and debt-to-equity ratio (how much debt you use to operate your company).

An external auditor can use a balance sheet to ensure a company’s complying with relevant reporting laws.

Because a balance sheet always uses historical data, it’s no guarantee of future performance. However, it’s commonly used to predict future performance by investors and stakeholders.

Information on a Balance Sheet

A balance sheet reports your business’s assets, liabilities, and shareholders as of a reporting date. Its reported items correspond to the accounts outlined on your chart of accounts.

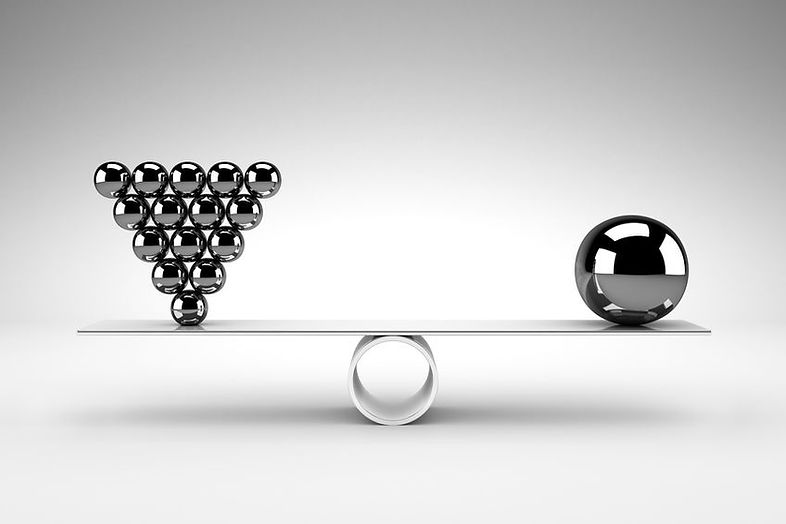

There are two sides to a balance sheet: assets are on the left side, and liabilities and owner’s equity are on the right. Both sides must balance each other out to give an accurate overview of a business’s financial performance.

You can use the information from the balance sheet to understand how much cash you have readily available. To allow for a safety net, always ensure your assets are more than your liabilities. This helps cover short-term financial obligations.

To learn about the amount of financial risk your business faces and how much leverage it has, compare debts to equity. You can also measure how efficiently your business uses its assets by comparing your income statement to your balance sheet.

The items on the balance sheets vary amongst organizations and industries. However, several line items are commonly found in all balance sheets, described below.

Assets

This section of the balance sheet reports anything of quantifiable value that your company owns. There are two types of assets: current and non-current. Your balance sheet lists assets in order of liquidity, which is the process of converting assets into cash.

Current assets are readily available to convert to cash within a year or less. They are broken down into various accounts:

- cash and cash equivalents: your most liquid assets such as your business’ checking and savings account balances,

- marketable securities: investments that you can sell quickly,

- accounts receivable: outstanding money that customers owe you,

- inventory: applicable for businesses that sell goods, and

- prepaid expenses: items such as your business insurance.

Non-current (long-term) assets require longer than a year to be converted to cash. They include fixed assets such as property and office equipment, long-term securities, and intangible assets, like patents and franchise agreements. Even when they’re not physical in nature, these types of assets often have the ability to make or break a company.

To keep the value of your assets accurate, you need to account for depreciation. There are several calculations available to help determine how much of an asset’s value has decreased over time.

Liabilities

After assets, a balance sheet outlines liabilities, which is what your company owes to outside parties. They can be both current and long-term and are listed in order from short to long-term obligations.

Debts that are due to the debtor within one year are known as current liabilities. Examples include payroll liabilities, rent and utility payments, debt financing, and accounts payable.

Long-term liabilities have a debt repayment of greater than a year. They include leases, loans, bonds payable, provisions for pensions, deferred tax liabilities, and future obligations to provide goods or services.

Owner’s Equity

Owner’s equity represents your company’s total net worth. It’s found by totaling up everything your business owns (the assets) and then deducting everything your business owes (the liabilities). On a balance sheet, total assets on one side must balance total liabilities plus owner’s equity on the other side.

Owner’s equity represents the amount of money initially invested plus earnings that your company generates and retains (profits). It acts as a funding source for your business and commonly funds expansions, debt payments, and reinvestment opportunities. In a publicly-traded company, owner’s equity is known as shareholder equity.

How to Read a Balance Sheet

Just like its name suggests, a balance sheet needs to always balance. To determine this, a formula is used that entails two parts that must equal each other. The information is commonly organized to the following equation:

Assets = Liabilities + Owner’s Equity

When two sides of the equation balance each other out, a company’s assets equal its debt and equity investment.

When a balance sheet doesn’t balance, something went wrong, and you need to determine what happened. Otherwise, you’re left with incorrect information that can affect accurate decision-making and the health of your business.

Reasons for an unbalanced balance sheet include data damage or misplaced data, incorrectly entered transactions, errors in currency exchange rates, changes in inventory levels, and miscalculations of equity, depreciation, or amortization.

To prevent balance sheet mistakes, keep financial documents organized, review balance sheet transactions regularly, and address any problems immediately. Seek the help of a qualified financial partner to avoid errors from happening in the future.

The Bottom Line

A balance sheet provides invaluable information for both internal and external stakeholders.

By highlighting your company’s assets, liabilities, and equity at a specific point in time, balance sheets make it easy to determine whether your company’s struggling or thriving.

Once you know that information, you can identify ways to double down on successes, correct failures, and work towards new opportunities.

Just like in the novel The Three Musketeers, the phrase “All for one and one for all” applies to your business’s finances as well. After all, your balance sheet becomes even more valuable when paired with your income and cash flow statements. Together, they provide you with the information you need to make the best decisions for your business.

Many small businesses struggle with understanding their financials and not knowing how to use that information to plan for their business. Schedule a consultation and we’ll help you understand your finances so that you can make better decisions and have a healthy and sustainable business.